Find the Cheapest Auto Insurance in Michigan: Save on Coverage Costs

Auto insurance is a necessity for drivers in Michigan, as it provides financial protection in the event of accidents, damage, or theft of their vehicles. However, the cost of auto insurance can vary significantly from one provider to another, making it essential for Michigan residents to find the cheapest auto insurance options available. By taking the time to research and compare different cheapest auto insurance in michigan providers and policies, Bonecu can save on coverage costs while still maintaining the necessary protection.

Find the Cheapest Auto Insurance in Michigan: Save on Coverage Costs

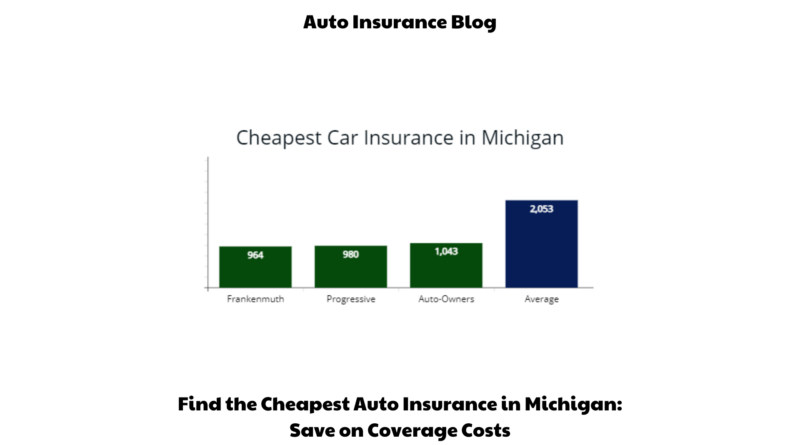

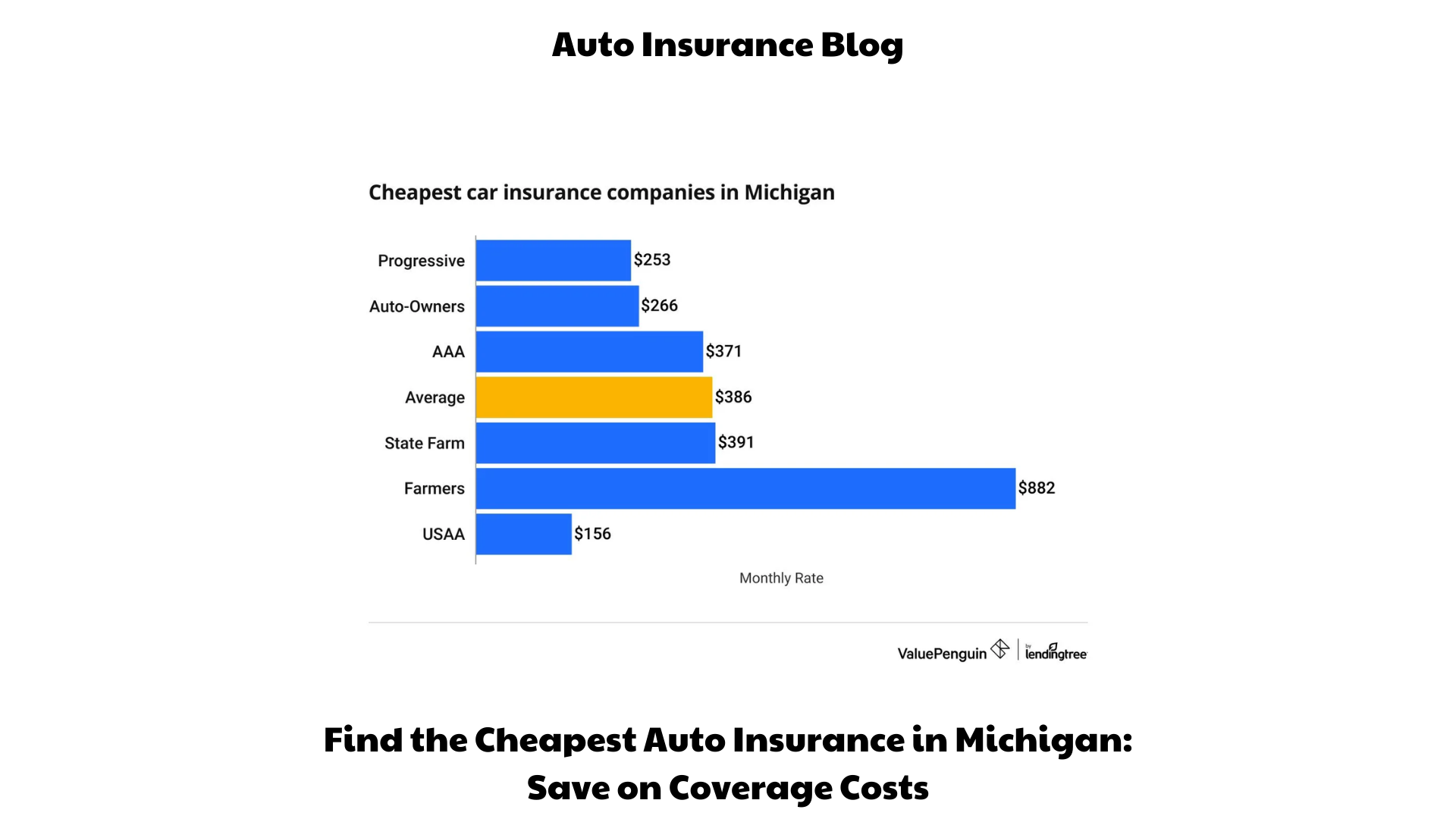

One of the first steps in finding the cheapest auto insurance in Michigan is to gather quotes from multiple insurance providers. Many insurance companies offer online quote tools that allow drivers to input their information and receive estimates for coverage. It’s important to provide accurate and complete information when obtaining these quotes to ensure the estimates are as accurate as possible.

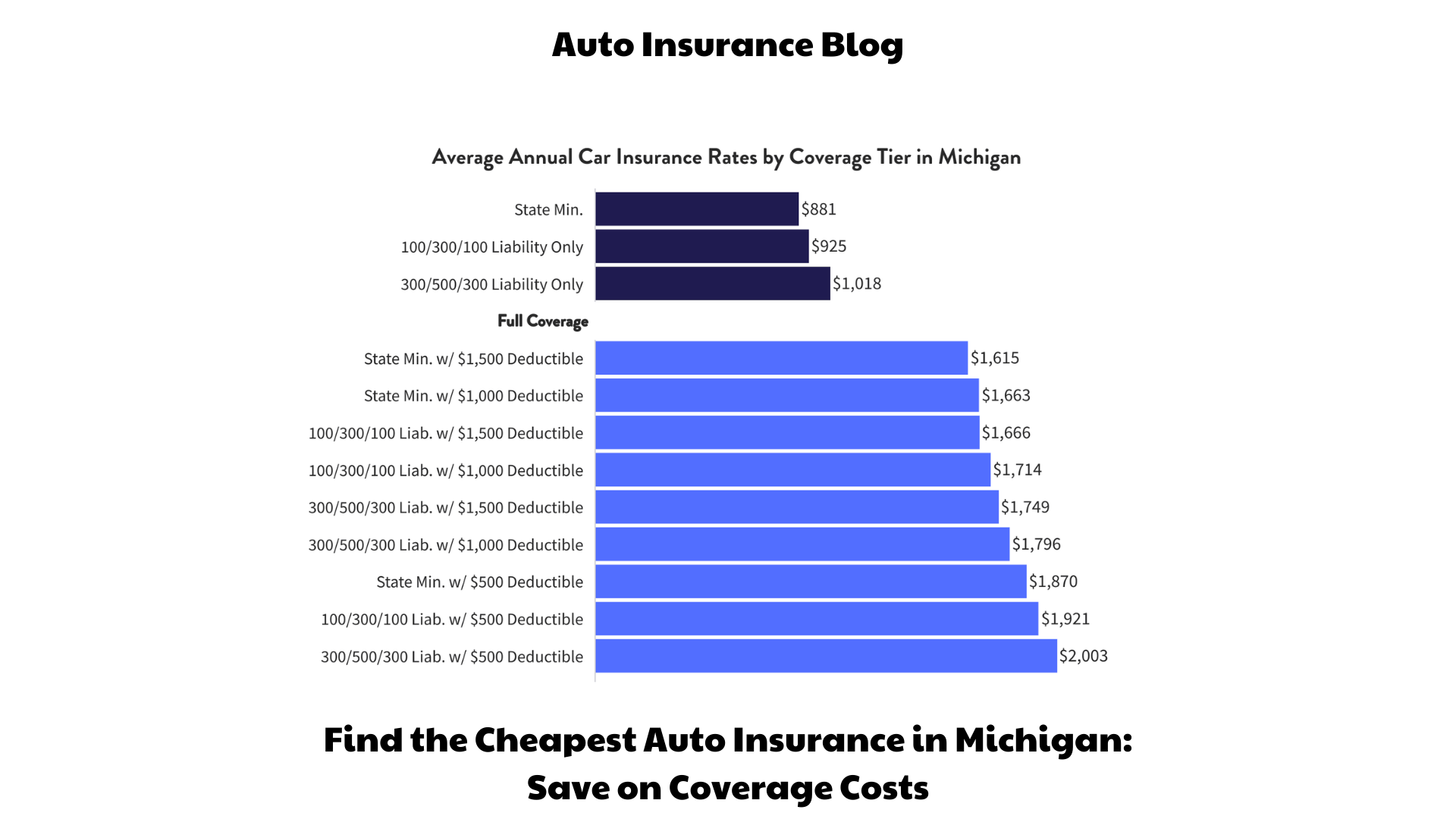

When comparing quotes, it’s crucial to consider the coverage limits and cheapest auto insurance in michigan deductibles offered by each insurance provider. While it may be tempting to opt for the lowest-cost policy, it’s essential to ensure that the coverage provided is sufficient to protect against potential risks. Cheaper policies may have lower coverage limits or higher deductibles, which could result in higher out-of-pocket expenses in the event of an accident or damage to the vehicle.

Another factor to consider when searching for the cheapest auto insurance in Michigan is the type of coverage required by the state. Michigan has specific requirements for auto insurance coverage, including personal injury protection (PIP) coverage. PIP coverage provides benefits for medical expenses, lost wages, and other related costs in the event of an accident. Understanding the minimum coverage requirements can help drivers make informed decisions about the type and level of coverage they need.

In addition to gathering quotes and considering cheapest auto insurance in michigan, it’s essential to research the reputation and financial stability of insurance providers. While cost is a significant factor in finding cheap auto insurance, it’s equally important to choose a reliable and reputable insurance company. Reading customer reviews, checking ratings from independent rating agencies, and researching the company’s financial strength can provide insight into their reliability and ability to pay claims.

Drivers in Michigan can also explore various discounts and savings opportunities to further reduce their auto insurance costs. Many insurance providers offer discounts for safe driving records, completion of defensive driving courses, bundling multiple policies, or having safety features installed in the vehicle. It’s cheapest auto insurance in michigan advisable to inquire about these discounts when obtaining quotes and to ask insurance providers about any additional discounts that may be available.

It’s worth noting that the cheapest auto insurance in Michigan for one driver may not be the same for another. Insurance premiums are determined by various factors, including the driver’s age, driving history, location, and the type of vehicle being insured. Therefore, it’s important for each driver to assess their own circumstances and needs when searching for the most affordable coverage.

Another strategy to find the cheapest auto insurance in Michigan is to consider raising deductibles. A deductible is the amount the policyholder must pay out of pocket before the insurance coverage kicks in. By opting for a higher deductible, drivers can often secure lower insurance premiums. However, it’s crucial to ensure that the chosen deductible amount is affordable and manageable in the event of a claim.

In some cases, joining a group or cheapest auto insurance in michigan association may provide access to discounted auto insurance rates. Certain professional organizations, alumni associations, or other groups may have partnerships with insurance providers that offer exclusive discounts to their members. It can be beneficial to inquire about such opportunities and explore any potential group affiliations that may result in lower insurance costs.

Additionally, maintaining a good driving record is essential for securing affordable auto insurance in Michigan. Insurance companies typically offer lower rates to drivers with clean driving histories and no recent accidents or traffic violations. Safe driving habits not only keep the roads safer but also contribute to lower insurance premiums.

Lastly, regularly reviewing and reassessing cheapest auto insurance in michigan insurance policies can help drivers ensure they are still getting the best rates. As circumstances change, such as vehicle ownership, driving habits, or personal information, it’s important to inform the insurance provider and update the policy accordingly. Failing to keep policy information up to date may result in inaccurate rates or potential coverage gaps.

In conclusion, finding the cheapest auto insurance in Michigan is a combination of diligent research, comparing quotes, and considering individual needs and circumstances. By gathering multiple quotes, understanding coverage requirements, researching insurance providers, exploring discounts, and maintaining a good driving record, drivers can increase their chances of securing the most affordable coverage options. It’s important to strike a balance between cost and adequate coverage to ensure financial protection and peace of mind on the roads of Michigan.