Cheapest Auto Insurance in Texas: Discovering the best 10 Insurances

Texas is a vast and diverse state, home to bustling cities, sprawling suburbs, and rural communities. For drivers in the Lone Star State, finding the cheapest auto insurance can be a daunting task, with a seemingly endless array of options and variables to consider. However, with Bonecu the right information and a strategic approach cheapest auto insurance in texas, you can uncover the most cost-effective coverage to protect your vehicle and your financial well-being.

Cheapest Auto Insurance in Texas: Discovering the best 10 Insurances

In this comprehensive guide, we’ll explore the 10 best and cheapest auto insurance in texas, equipping you with the knowledge to make an informed decision and secure the coverage you need at a price you can afford.

Geico

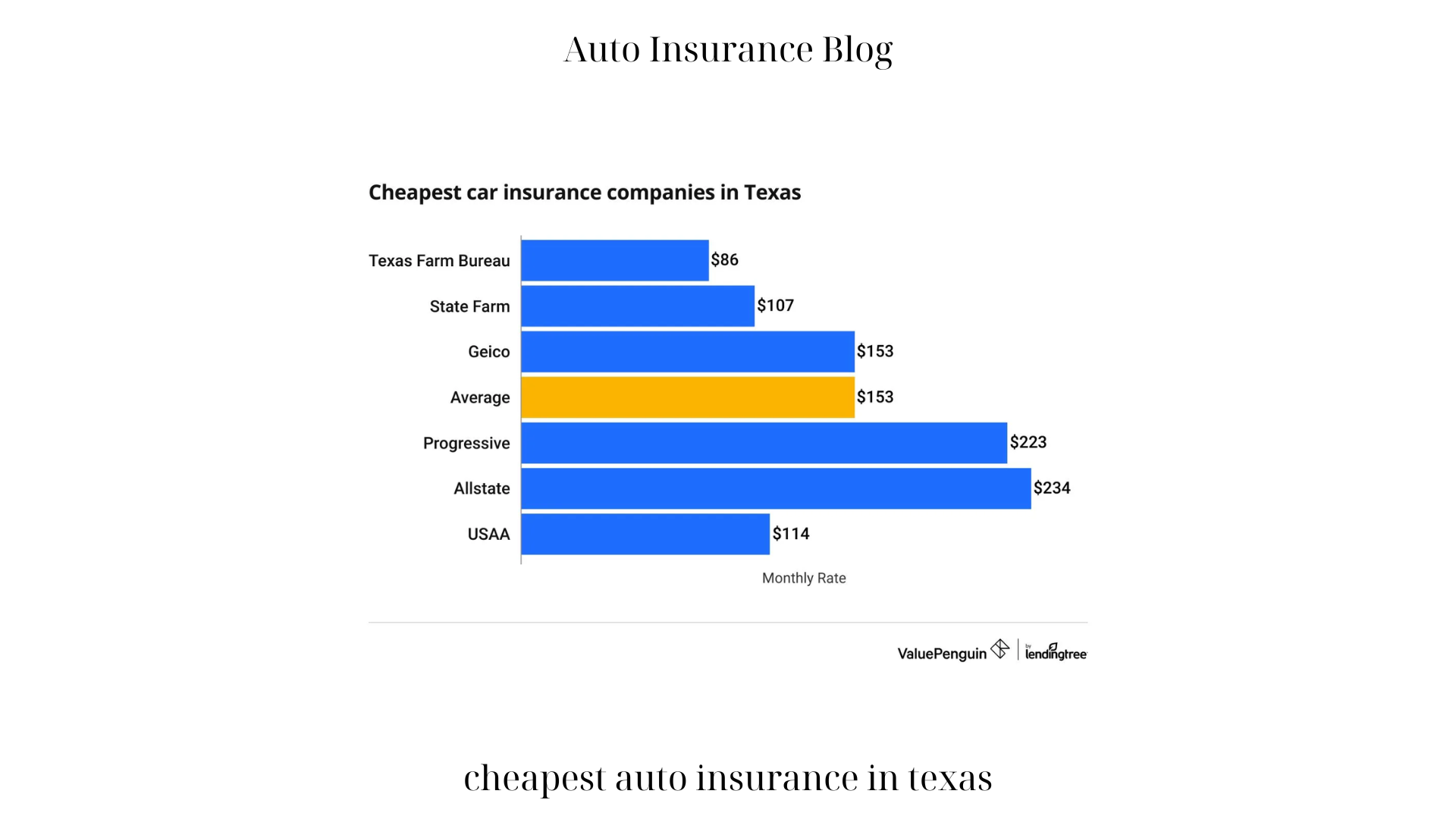

Renowned for its quirky marketing campaigns and commitment to cheapest auto insurance in texas customer service, Geico is a perennial favorite among Texas drivers seeking cheap auto insurance. The company’s extensive discounts, including those for military personnel, good drivers, and safe vehicles, can significantly reduce premiums. Additionally, Geico’s user-friendly online platform and mobile app make it easy to manage your policy and file claims, enhancing the overall customer experience.

State Farm

As one of the largest and most established insurance providers cheapest auto insurance in texas in the United States, State Farm has a strong presence in the Texas market. The company’s affordable rates, combined with its wide range of coverage options and discounts, make it an attractive choice for drivers seeking cost-effective auto insurance. State Farm’s financial stability and reputation for exceptional customer service further bolster its position as a top contender for the cheapest auto insurance in Texas.

Progressive

Progressive has earned a reputation for innovation and embracing technology, and this approach extends to its auto insurance offerings in Texas. By leveraging data-driven pricing models and personalized discounts, Progressive often delivers some of the lowest rates in the state. The company’s user-friendly online platforms and mobile apps make it easy for Texas drivers to obtain quotes, manage their policies, and file claims with ease.

Allstate

Allstate’s long-standing presence in the Texas cheapest auto insurance in texas market and its focus on customer satisfaction make it a reliable choice for affordable auto coverage. The company’s diverse range of discounts, including those for good drivers, safe vehicles, and bundling policies, can help Texas drivers maximize their savings. Allstate’s comprehensive coverage options and responsive claims process further solidify its position as one of the best and cheapest auto insurance providers in the state.

USAA

Exclusively serving members of the military, cheapest auto insurance in texas, and their families, USAA is a trusted name in the insurance industry. While USAA’s auto insurance policies may not be available to the general public, the company’s commitment to serving its niche market often results in some of the most competitive rates in Texas. USAA’s exceptional customer service and comprehensive coverage make it a top choice for eligible Texas drivers seeking the cheapest auto insurance.

Nationwide

Nationwide’s strong presence in the Texas cheapest auto insurance in texas market and its focus on customer-centric policies make it a viable option for affordable auto coverage. The company’s wide range of discounts, including those for good drivers, safe vehicles, and policy bundling, can help Texas drivers significantly reduce their premiums. Nationwide’s user-friendly digital platforms and responsive claims process further enhance the overall customer experience.

Travelers

Travelers has long been recognized for its cheapest auto insurance in texas stability and commitment to providing reliable insurance solutions. In the Texas auto insurance market, the company’s competitive rates and comprehensive coverage options make it a standout choice for drivers seeking the cheapest coverage. Travelers’ customer-focused approach and emphasis on risk management strategies can also help Texas drivers save on their premiums.

MetLife

As a global insurance powerhouse, MetLife cheapest auto insurance in texas its expertise and resources to the Texas auto insurance market. The company’s focus on personalized solutions and data-driven pricing models often result in some of the most affordable rates for Texas drivers. MetLife’s broad range of coverage options and commitment to customer service further solidify its position as one of the best and cheapest auto insurance providers in the state.

Liberty Mutual

Liberty Mutual has a strong presence in the Texas insurance landscape, offering competitive rates and a diverse range of coverage options. The company’s emphasis on customizable policies and innovative risk management strategies can help Texas drivers find the cheapest auto insurance that meets their specific needs. Liberty Mutual’s responsive claims process and commitment to customer satisfaction also contribute to its status as a top choice for affordable coverage in the state.

Farm Bureau

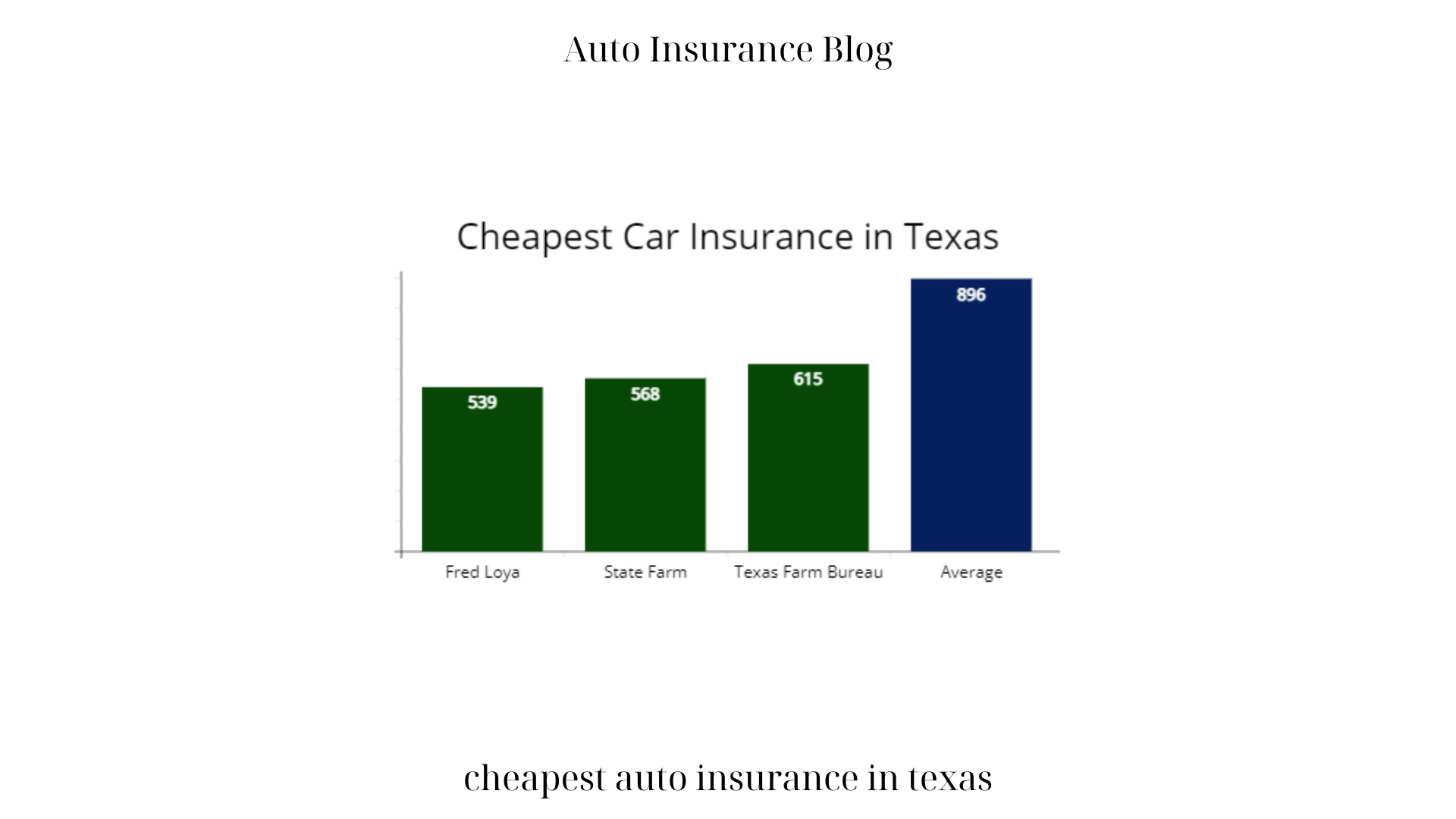

Serving the unique needs of Texas’ agricultural and rural communities, Farm Bureau offers auto insurance policies that are often among the most affordable in the state. The company’s deep understanding of the local market, combined with its focus on personalized service and community engagement, makes it a popular choice for Texas drivers seeking cost-effective coverage. Farm Bureau’s discounts for safe driving, vehicle safety features, and policy bundling can further enhance the affordability of its auto insurance offerings.

As you navigate the Texas auto insurance cheapest auto insurance in texas, it’s essential to remember that the cheapest option may not always be the best fit for your specific needs. Consider factors such as coverage limits, deductibles, and the financial stability of the insurance provider when evaluating your options. Additionally, be sure to explore all available discounts and personalization opportunities to maximize your savings.

By taking the time to research and compare the 10 best and cheapest auto insurance in texas, you can make an informed decision that protects your vehicle, your finances, and your peace of mind. Remember, the right auto insurance policy can provide the coverage you need at a price you can comfortably afford, allowing you to focus on the road ahead with confidence.